Raisely helps ambitious non-profits and charities fundraise online by making it simple to build a beautiful fundraising website that engages your supporters, takes donations, and sends compliant tax receipts. That's the part we're going to talk about today.

When we set out to build a fundraising platform, we knew receipts were important. That's obvious right? You're accepting donations and just like any time you accept money from someone, you need to acknowledge it with a receipt.

What we didn't know at the time was how complex receipting is for charities. It's not just about the acknowledgement of your donor's generous gift. There are a myriad of different receipting laws you need to comply with. Those change too – based on the country you're operating in, whether you're endorsed as tax deductible by your government, and the kind of gift you're receipting.

It's our job to handle all of this technical complexity for you. As more organisations from across the world have started using Raisely to process donations, it's on us to make sure it's simple to send receipts that are compliant *and* best practice.

So today we're announcing a major upgrade to receipting on Raisely. We're making it easy to send elegant PDF receipts to your donors, and we're baking in all of the functionality you need to be compliant in Australia, the US, the UK, New Zealand, and (the winner of the most complex receipting laws award) Canada.

So what actually needs to be on a receipt?

Let's say I'm a charity accepting donations. Fairly universally, my receipt will need to contain some information about my charity like my organisation's name, logo, address and registration numbers. It'll need to contain the date of the donation, the amount given, and who gave it.

In New Zealand and Canada, I need an authorised signature, name and designation on my receipt to make it official. I'll also need a unique reference number for my donation.

My donor will need to keep a record of their receipt for tax purposes. In most countries that can be an email, but it is so much easier for everyone when it's a PDF.

What about when I resend a receipt to my donor? Well it's best practice to indicate that the receipt is a resend everywhere, and it's required in New Zealand and Canada.

Those two countries also require a receipt number, unique to each receipt (including those you resend). In Canada, you must void any past receipts when you resend a fresh one.

If my donation is endorsed as tax deductible, I need to indicate that on the receipt too. Unless I'm receipting for a membership fee, registration fee, or for anything else that isn't tax deductible.

Speaking of registration fees, I probably need to include sales or services tax on that. If part of my payment is a registration fee, and part is a donation, well I'll need to specify that too along with how much tax applies, and how much of my payment is tax deductible.

... annnnd breathe... 🧘

How we're now doing receipting on Raisely

Let's start with the biggest change we've made. You can now set up a simple, elegant PDF donation receipt attached to the email you send donors after they give. No more tables or receipt details in the body of the email.

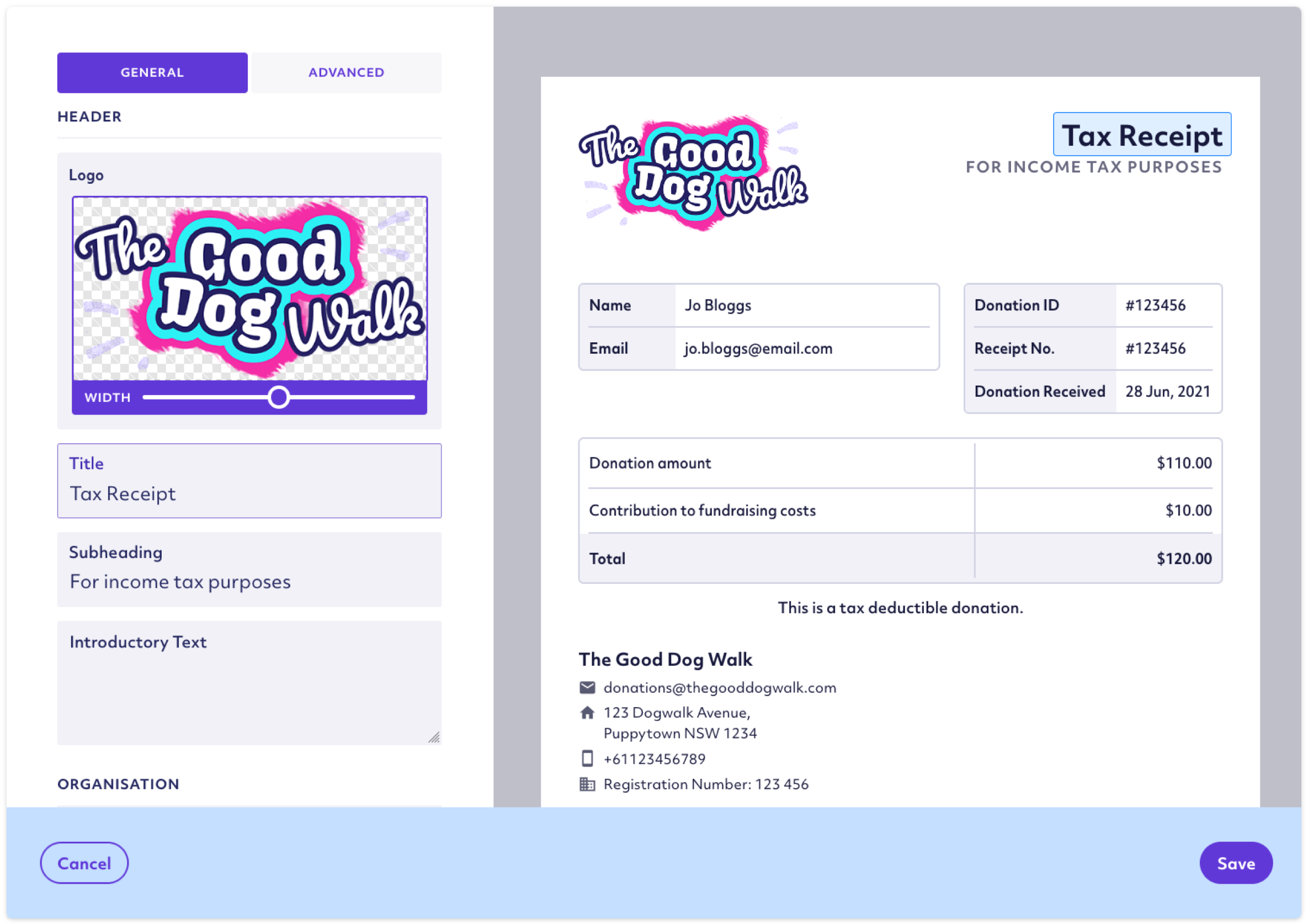

Our new PDF receipts have been designed to be clear, simple, and compliant. They'll work with any charity brand, and you can customise almost everything on them. Here's an example of how they look:

You can customise your donation receipt template with your own logo, text, and charity details. The table on the receipt will automatically update to accommodate registration fees, taxes, tax deductibility, and merchandise sales.

💡Already using Raisely? We've made a quick guide to show you how to move over from email receipts to PDF receipts.

If you're fundraising for multiple charities under the one Raisely account, we've covered that too. While each campaign will have a default receipt, you can customise a fresh template for every Stripe account you've connected to Raisely. We'll automatically send the right receipt, based on your payment routing rules.

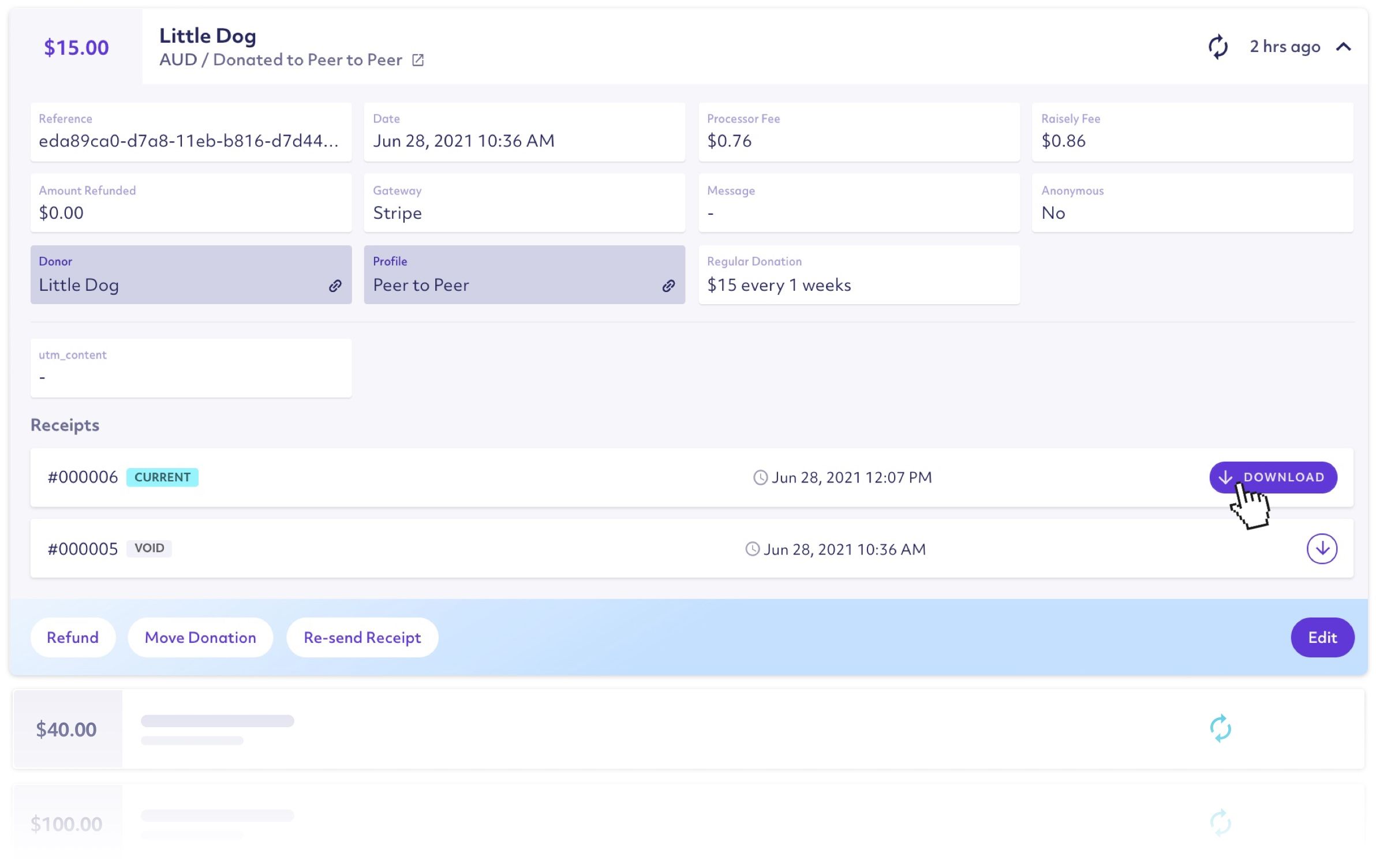

We've made it easier to manage your receipts too. If you need to print a receipt, or want to send one manually to a donor, you can see and download the PDF copy right from the admin panel.

When you resend a receipt to your donor, we'll automatically generate a new one with a unique ID and void any past receipts. The resent copy will include the word "Replacement" on it, indicating it is a resent receipt.

Lastly, we believe it's essential that you're able to access all of the data you hold in Raisely. So we've added a new Donation Receipts report to download all of the individual receipts you've sent, along with their status and the details of the donation they were for.

Ready for an easier way to do donation receipting?

We've been previewing these features in beta for a couple of weeks, and they're now ready for everyone! If you already fundraise on Raisely, check out this guide to show you how to set up new PDF receipts.

Ready to create your

next campaign?

CEO/Co-founder at Raisely